extended child tax credit calculator

File a federal return to claim your child tax credit. Child Tax Credit Per dependent up to.

Pay Tds On Time Or Else Face Imprisonment Tax Deductions Budgeting Paying Taxes

Child Dependent Care Credit For 2 dependents up to.

. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. For children under 6 the amount jumped to 3600.

Get your advance payments total and number of qualifying children in your online account. Its called the expanded Child Tax Credit and its part of President Bidens COVID relief package. The federal government also provided three sets of economic impact payments to individuals and families to help them get through the.

If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. Enhanced credit could be extended through 2025. The percentage falls by 1 for every additional 2000 of income until.

If your income is below 15000 you will qualify for the full 35. The first one applies to the extra credit amount added to. Discover Helpful Information And Resources On Taxes From AARP.

The JCT has made estimates that the TCJA changes. Enter your information on Schedule 8812 Form 1040. Dont worry TurboTax will be sure you get every deduction and credit you deserve.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Are You a Student or a Teacher. Its a much bigger credit for potential taxpayers in tax year 2021.

Tax Changes and Key Amounts for the 2022 Tax Year. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Your amount changes based on the age of your children. To reconcile advance payments on your 2021 return. Simple or complex always free.

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. You may qualify for the following deductions and credits. Ad Find Out How Much Your Child Dependent Care Tax Credits Are Worth.

The maximum child tax credit amount will decrease in 2022. The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid. Earned Income Tax Credit EITC For 3 dependents up to.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. Child Tax Credit amounts will be different for each family. The Earned Income Tax Credit would also get extended to 2022 and pay up to 6728 depending on tax filing status annual income and number of children.

How many can I claim. The percentage you use depends on your income. The expanded Child Tax Credit would be extended for 2022 and pay qualifying families 300 monthly for each child under age six and 250 for each child between ages six and 17.

For married couples and joint filers the credit will dip below 2000 if their. Ad See If You Qualify To File For Free With TurboTax Free Edition. The payment for children.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. 30003600 child tax credit. Advance child tax credit payments in 2021 reduced child poverty by 40.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Parents with higher incomes also have two phase-out schemes to worry about for 2021. The American Rescue Plan Act of 2021 has upped the child tax credit substantially as high as 3600 per child ages 5 and under for qualifying people.

Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for. Partial Expanded Child Tax Credit. If your MAGI is over 75000 the credit is phased.

This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Child tax credit.

Child and Dependent Care Credit Value. And families without kids may be eligible for funds through the expanded Earned Income Tax Credit too.

Monthly Spending Budget Template

Calculate Child Support Child Support Calculator 2019

Sr Ed Tax Credit Calculation Refundable Tax Credits How To Examples

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

September Child Tax Credit Payment How Much Should Your Family Get Cnet

September Child Tax Credit Payment How Much Should Your Family Get Cnet

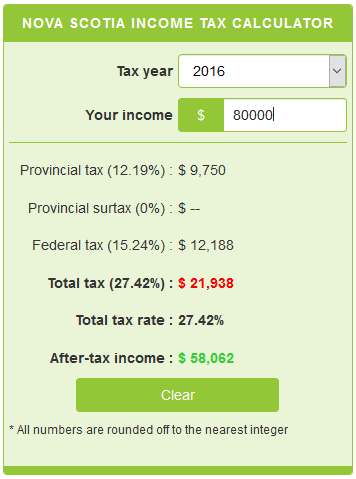

Nova Scotia Income Tax Calculator Calculatorscanada Ca

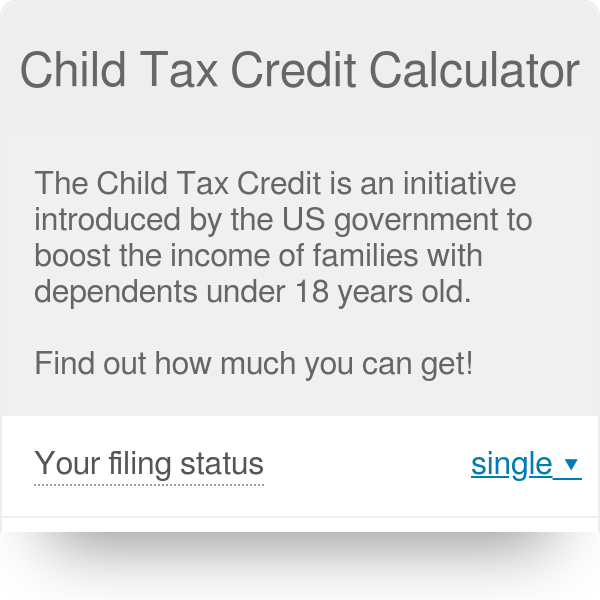

Try The Child Tax Credit Calculator For 2021 2022

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Our Team Southwest Tax Associates

Income Tax Calculator Estimate Your Refund In Seconds For Free

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

How To Calculate Taxable Income H R Block

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit Calculator How Much Could You Receive Abc News